Have an access code? Explore the platform here

The AI-Native Engagement Layer for Wealth Management

Turn every client question into actionable insight — securely, compliantly, and at scale.

Have an access code?Explore the platform here.

Finance Was Built for Branches.

People Now Live in a Digital-First World.

Modern clients expect more than statements and dashboards — they want personalized conversations, real-time insights, and confidence in their financial future.

But traditional wealth management infrastructure hasn't caught up with digital-first expectations, leaving advisors overwhelmed and clients underserved.

That's where we come in.

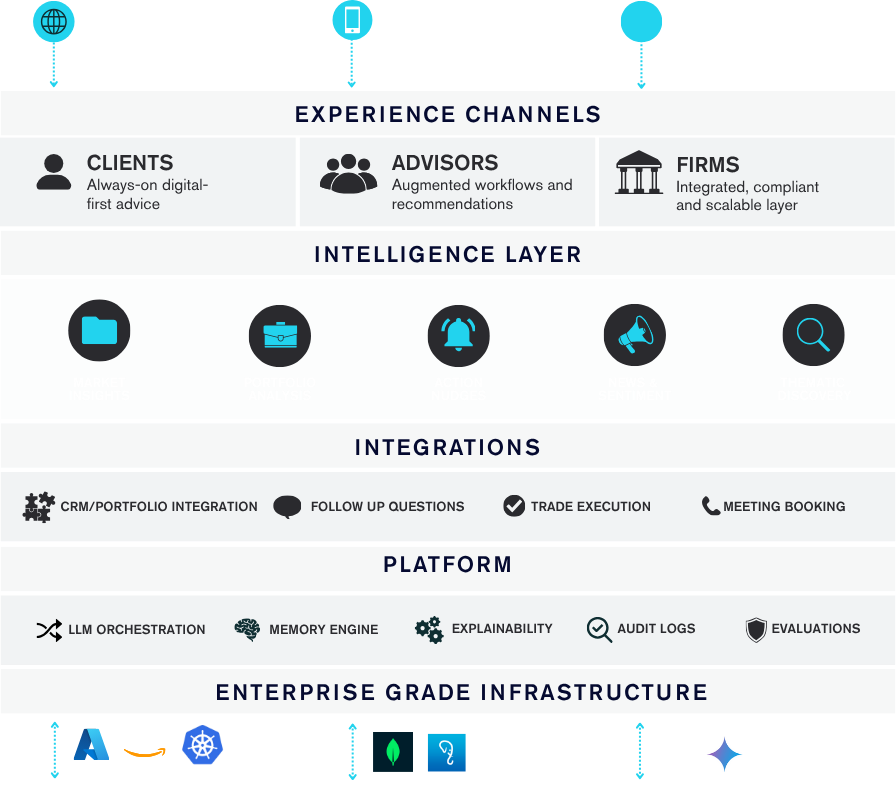

The Intelligence Layer Behind AI Wealth Management

A modular AI wealth management platform that integrates seamlessly into your existing systems, connecting client data, portfolio intelligence, and personalized engagement across all touchpoints.

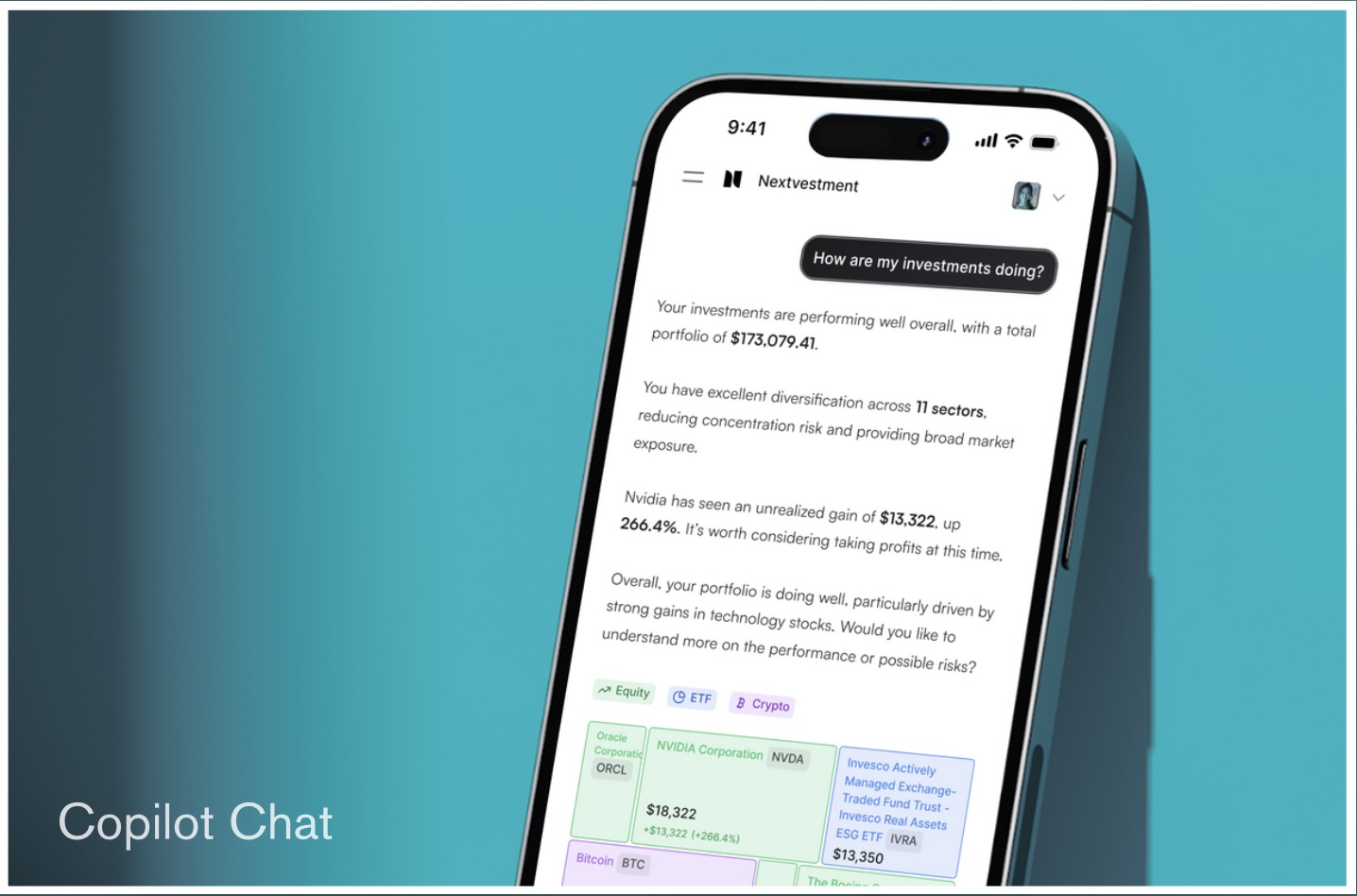

Personalized Conversations

Natural-language wealth management insights tailored to each client's portfolio and goals, delivered through explainable, compliant, and contextual AI conversations.

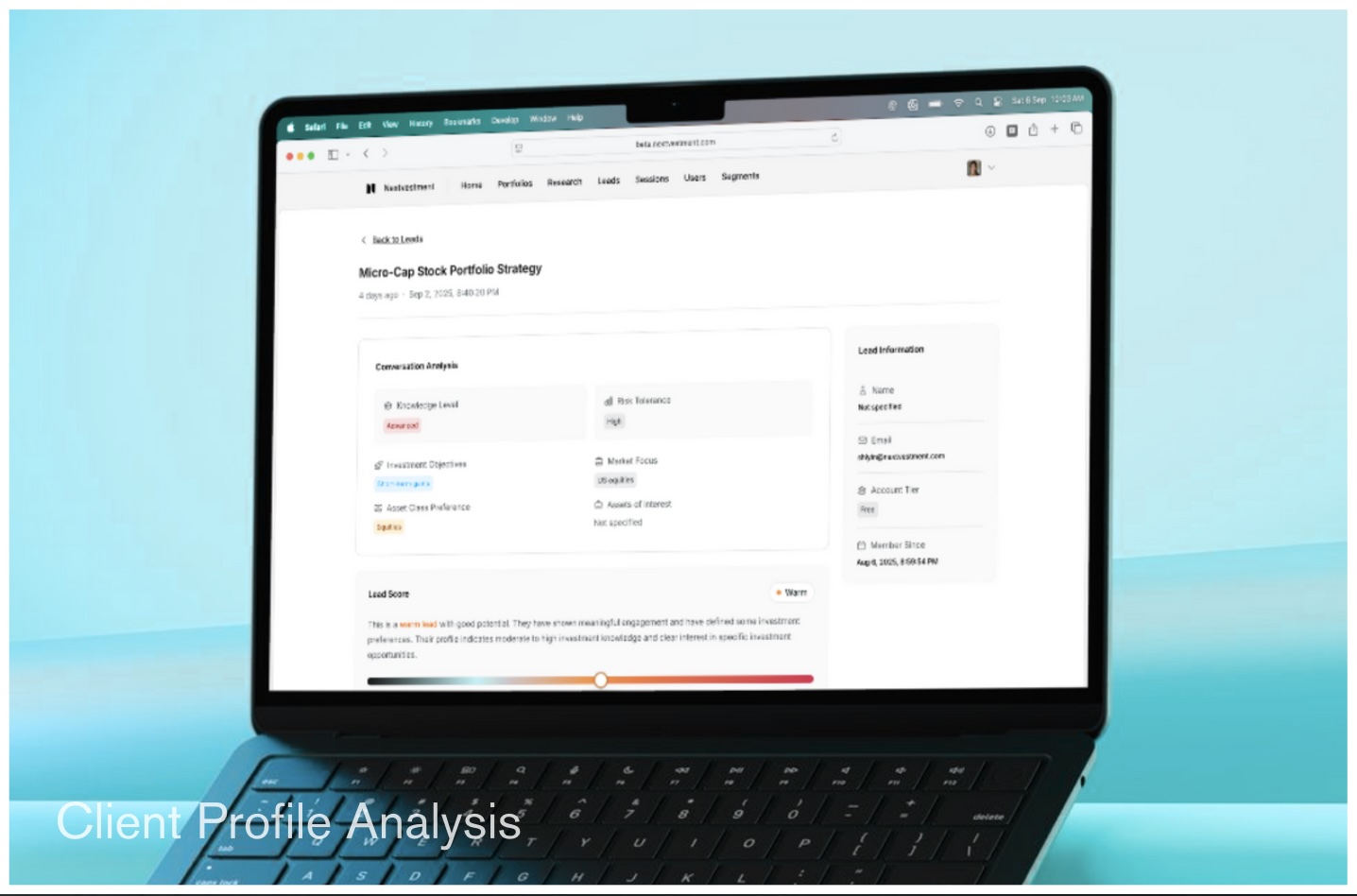

Advanced Portfolio & Client Analysis

Real-time wealth management analysis of holdings, risk profiles, and client preferences — powering personalized investment advice and portfolio optimization.

Client Behavioral Intelligence

Advanced behavioral analysis that identifies client intent, engagement patterns, and warm prospects using wealth management interaction data to drive personalized outreach.

Enterprise-Grade Architecture

Modular, compliant architecture that integrates securely into existing wealth management workflows. Enterprise-ready, information security and audit compliant, and designed for financial institutions.

How Institutions Deploy Nextvestment

Our modular wealth management platform integrates directly into existing workflows — connecting client insights, advisor actions, and firm systems across all channels without disrupting your current infrastructure.

Proven Results with Regulated Financial Institutions

Already deployed with leading banks, wealth management firms, brokerages, and family offices, delivering measurable improvements in client engagement and advisor productivity.

$65bn

IN Combined AUM across institutions powered by nextvestment

40%

CLIENT ENGAGEMENT RATE - ACHIEVED WITHOUT OUTBOUND MARKETING

1 in 10 clients

take an investment action after interacting with our tools